elrs.kerala.gov.in Education Loan Repayment Support Scheme 2017 : Finance Department

| Want to comment on this post? Go to bottom of this page. |

|---|

Organisation : Finance Department, Government of Kerala

Facility : Education Loan Repayment Support Scheme

Applicable State : Kerala

Application Last Date : 31.10.2017

Notification : https://www.scholarships.net.in/uploads/17549-loan.doc

Website : http://www.elrs.kerala.gov.in/

Education Loan Repayment Support Scheme :

The Government has now proposed an Education Loan Repayment Support Scheme which is intended to help those who are struggling to repay the education loan debts after the completion of their course.

Related / Similar Post : ELRS Kerala Track Scholarship Status

Applicability Conditions :

** The student should be an individual permanent resident of Kerala

** The KYC records should match with that provided with the bank

** Only those education loans availed from a branch situated in Kerala, of, a scheduled commercial bank, Kerala Gramin bank Kerala State Co operative Bank, KSCARD Bank or any of the 14 District Co operative banks in the state are covered under the scheme

** Students who secured admission under Management seats/management quota/NRI Quota are not eligible.

Update : New Facility for submitting online application for availing government support under standard category for the year 2018-19 has been introduced in the portal.Eligible students are requested to submit the claim application through the portal with mandatory documents.

Management seats /management quota refers to seats in private education institutions for which the management has discretion to give admission on factors other than merit as explained in IBA’s “Revised guidance notes on model educational loan scheme for pursuing higher education in India and abroad -2015 (Amended 2016)

** However, Students who secured admission under Management quota/Management seat for nursing courses are also eligible.

** Loans taken for study abroad are not eligible

** Income Tax Permanent Account Number (PAN) for the student borrower (for co borrower, in the case of a deceased student ) is a pre requisite for registration

** Upper limit for present annual gross family/parental income is Rs.9 lakhs for deceased students, and students with disability of 40 % or more and 6 lakhs for all other categories.

** In addition to the above , the present Annual Income of student should be within 4 times of the scheduled annual repayment amount in the loan

** Student borrowers who become permanently mentally/physically disabled with 80% or more disability due to accident/ illness or expired during the course of study/ tenure of the loan after availing the loan will be eligible for financial assistance irrespective of date and sanctioned amount of loan and classification of loan account.

Procedure to be followed by borrower for filing claim application :

The procedure for filing the claim application involves following 6 steps.

1.Registration

2.Uploading certificates

3.Filing the claim application

4.Online Submission of claim to bank

5.Submission of signed printout of application with original certificates to bank

6.Remitting the borrower’s contribution in advance with the bank

1. Registration :

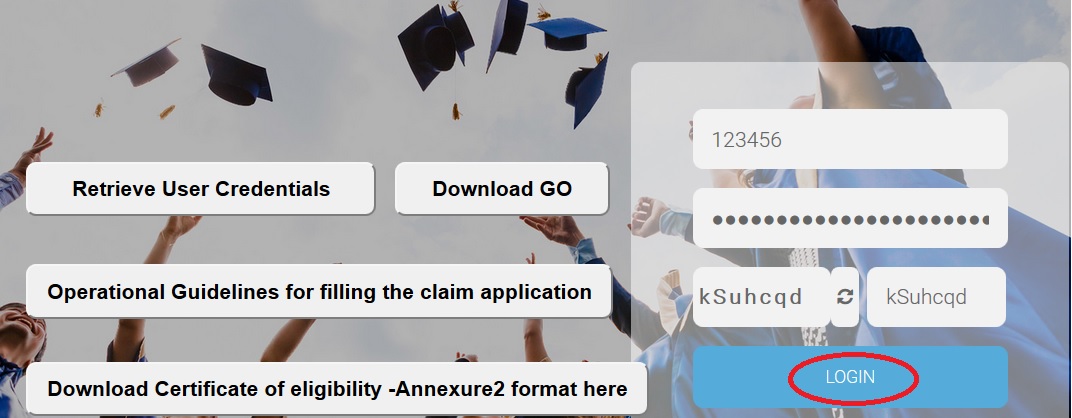

** To apply for financial assistance under the scheme, the first step is to get registered in the elrs.kerala.gov.in portal.

** The applicant has to choose an option as applicable to the student. The options are

1.Normal student

2.Student who suffered 80 % or more permanent physical or mental disability after availing the loan

3.Deceased student

4.Student suffering 40 % and above but below 80% permanent disability (Including any pre existing)

** For options 1 & 4, registration is to be done by the student

** For options 2 & 3, registration may be done by the co borrower

The following data fields are mandatory for registration

1)Name of student ,

2)Gender of student ,

3)Date of Birth of student ,

4)10th std examination roll number of student ,

5)Year of 10th passing,

6)Name of the 10th standard board,

7)Mobile number of student (co borrower in the case of student deceased/suffered 80 % or more disability)

8)Email id of the student (co borrower in the case of student deceased/suffered 80 % or more disability)

9)Income Tax PAN of the student (co borrower in the case of student deceased/suffered 80 % or more disability)

** During the course of registration an OTP will be generated and sent to the mobile number of the applicant. This OTP is to be entered for completing registration

2. Uploading Certificates :

** The applicant is required to upload copies (in PDF format) of the following certificates.

i) At the time of Registration

1) Copy of 10th pass certificate of student ,

2)Copy of Aadhaar of student (of co borrower in the case of student deceased/suffered 80 % or more disability) ,

3)Income Tax PAN of student (of co borrower in the case of student deceased/suffered 80 % or more disability)

ii) At the time of filing application

1)Eligibility certificate issued by the Village Officer and countersigned by a gazetted Officer.(The format can be downloaded from the portal)

2)Death Certificate issued by the Registrar of Deaths of the concerned local body (in the case of deceased student)

3)Disability certificate by competent authority as stipulated in the Persons with Disabilities Act 1995 (in the case of a student borrower suffering permanent physical/mental disability of 40 % or more)

4)Course Completion certificate pertaining to the course for which the education loan was availed). (If the student discontinued the course for medical or other valid reasons, a certificate from the head of institution, stating the reason for discontinuation)

5)Salary certificate in the case of a student employed in formal sector (not applicable for deceased/student with % or more disability)

** After filling the mandatory fields and uploading the certificates, the registration form is to be submitted.

3. Filing Claim Application :

On completion of the registration, a user ID and password will be sent to the registered mobile number of the applicant. For filing claim application, the applicant has to login to the portal and enter the following information using this user ID and password.

** Full permanent address of the applicant

** Name of parent/spouse/guardian

** Details of co borrower(in the case of student deceased or suffered 80% & more disability)

** Details of the professional course studied (for which the education loan was availed)

** Whether Management & NRI Quota or not

** Date of completion of course

** Category of the student

** Details of the bank from which loan was availed

** Details of the loan availed

** Amount repaid (interest subvention shall not be treated as repayment for this scheme)

** Present Annual income of the family

** Present employment details of student (not applicable for deceased student/student with 80% or more disability)

** Present Annual income of the student (not applicable for deceased student/student with 80% or more disability)

** Date of occurrence of disability/death in the case of deceased student /student with 80% or more disability

** Details of relief availed under any other scheme (if any)

** Choosing Govt Support category

i) For applicant under option 1 (Normal) & option 4 (40 % or more but below 80% disability)

** He/She has to mark whether account was NPA as on 2016 March 31st or not

** If the account was not NPA , the Govt support would be available as per the applicability conditions described under category I above and other conditions stipulated under category 2(d)I(i) of the guidelines issued vide GO(P) No. 65/2017/Fin. Dated 16.05.2017.

** For NPA accounts with loan sanctioned limits up to Rs. 4 lakhs the Govt support would be available as per the applicability conditions described under category II(a) above and other conditions stipulated under category 2(d)I(ii)(a) of the guidelines issued vide GO(P) No. 65/2017/Fin. Dated 16.05.2017.

** For NPA accounts with loan sanctioned limits above Rs. 4 lakhs upto Rs. 9 lakhs, the Govt support would be available as per the applicability conditions described under category II(b) above and other conditions stipulated under category 2(d)I(ii)(b) of the guidelines issued vide GO(P) No. 65/2017/Fin. Dated 16.05.2017.

ii)For applicant under option 2 (80% or more disability) & 3 (Deceased Student) )

** The Govt Support would be available as per the applicability conditions described under category III above and other conditions stipulated under category II of the guidelines issued vide GO(P) No. 65/2017/Fin. Dated 16.05.2017.

4. Online Submission of claim to bank :

** After filling all the fields and uploading the certificates, the applications can be submitted online in the portal

5.Submission of signed printout of application with original certificates to bank :

** Once the application is submitted successfully, the portal will generate a PDF copy of the application along with the certificates uploaded

** The applicant has to submit a printout of this in full and sign at the places required.

** This duly signed printout along with the originals of the uploaded certificates is to be submitted to the bank branch where loan is maintained.

Last date for submission of application :

The last date for submission of application will be 31.10.2017.